Robert M. Calvani, FAIA, NCARB

2017-2018 Treasurer

Note: This report is adapted from Treasurer Robert M. Calvani’s 2018 Annual Business Meeting speech.

Fiscal Year 2018 was a very busy year at NCARB.

Financial Highlights

To begin my report, I want to start by sharing some significant financial highlights demonstrating how the Council is going even further.

- We served our members and Record holders for an eighth consecutive year without fee increases.

- We negotiated a lease for a new office that will save the Council approximately $5 million dollars over the next 15 years.

- We funded our short-term reserves to the maximum established by the Council’s financial policies.

- The Strategic Reserve Fund is at the highest level in the history of NCARB.

- We have begun marketing NCARB-proprietary software, which we hope will produce new revenue streams for the Council.

There are four major topics covered in this report:

- The financial results for Fiscal Year 2018, which ended on June 30, 2018;

- The state of the Council’s financial accounts;

- The proposed budget for FY19, as well as anticipated financial outcomes for the next few years; and

- New business opportunities.

FY18 Year-end Results

We ended FY18 with a $1.9 million surplus. $1.2 million of this surplus is the result of our operating activities. The remaining $700 thousand is from gains on our Strategic Reserve investment portfolio. We do not budget for market gains or losses in our portfolio.

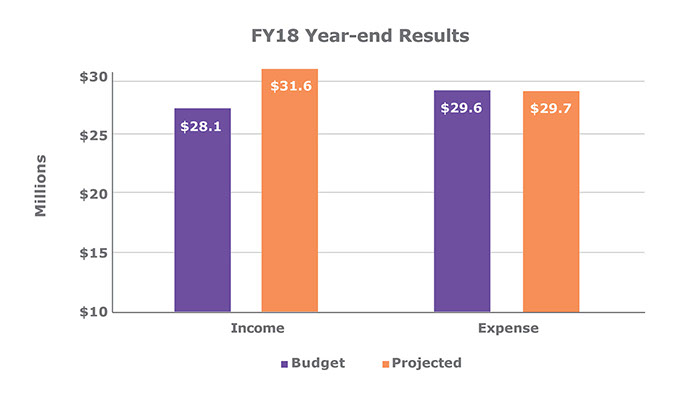

This chart shows FY18’s ending income and expenses compared to our budgeted income and expenses. The two bars on the left are income, and the two bars on the right are expenses. The purple bars represented what was budgeted, while the orange bars represent the year-end results.

Focusing on the income bars on the left, you can see that we exceeded budget projections by $3.5 million. On the right, you can see that expenses were on target. The excess income resulted largely from exam activity that was much higher than anticipated in this final year of transition from the Architect Registration Examination® (ARE®) 4.0 to ARE 5.0.

First question: Where did the $1.2 million net operating surplus come from?

- The purple section of the chart shows 94 percent of the net revenue was generated by exam activity—in both ARE 4.0 and 5.0—that exceeded expectations. We always experience increased testing levels in the existing exam when it will be replaced by a new version, so this was anticipated. Even so, actual testing volumes still exceeded those elevated expectations.

- The orange section of this chart shows that 4 percent of the net revenue came from a healthy pipeline of licensure candidates, surpassing expectations for pre-licensure services.

- In the green section, the final 2 percent of the net revenue came from architect services, mostly related to reciprocity transmittals and other small revenue sources.

Second question: How was the $1.2 million net surplus utilized?

- We have increased our checking account balance since June 30, 2017;

- We have fully funded our short-term reserve portfolio;

- We have added to our Strategic Reserve Fund; and

- We have improved and upgraded our operating systems.

Increasing these funds—in addition to the amounts added to our Strategic Reserve Fund in the past few years—will allow us to further our strategic goals of facilitating licensure, fostering collaboration, and centralizing credential data, as well as continuing to grow services for our Member Boards.

Council Financial Health

The Board has designed the structure of the Council’s accounts to follow industry best practices. These funds have allowed us to plan for future development opportunities, decrease fees (we plan to reduce the transmittal fee from $400 to $290 over the next four years), continuously improve our technology systems (for example, development of a continuing education auditing system), develop and defend the ARE, and protect against economic downturns.

In this chart, each of the Council’s financial accounts is represented by a bar. Each account has its own specific purpose: the checking account, short-term savings, and strategic investment portfolio.

The purple line on the first two bars of this chart denotes the top of the target range that the Board has defined as the maximum balance to be held in the checking and short-term savings accounts. Together these accounts can provide funding for up to three months of expenses if circumstances dictated. Both of these funds were at the top of the range as of June 30, 2018.

The third bar shows the status of the Council’s Strategic Reserve Fund. The portfolio returned $700 thousand in market gains this year. These returns, combined with the contributions mentioned above, brought the balance to $19.5 million. The bar near the top shows the minimum target balance for this fund is $21.2 million, which is good business practice and is generally in line with the long-term reserves of other nonprofit organizations similar to NCARB.

The $21.2 million minimum target was derived from a study of NCARB’s specific business opportunities and risks performed by our auditors, Tate & Tryon, during the course of FY18. The Board of Directors reviewed that study, evaluated the proposed minimum reserve amounts, and established the $21.2 million minimum reserve at that time. This study will be repeated at least once every four years and the Strategic Reserve amounts updated, if appropriate, based on the results of the study. This investment portfolio also serves as collateral for a line of credit. The line of credit allows the Council to take advantage of future business development opportunities.

The fourth bar in the chart is a special short-term fund. Planning has already started on recognizing NCARB’s Centennial in 2019. The Board of Directors set aside a special Centennial Fund two years ago so that it will not be necessary to use reserve funds in FY19.

FY19 Budget

In FY19, we have approved a $1.3 million budget deficit. We will rely on the higher balances in the checking and short-term savings accounts to cover operations and avoid raising fees.

The $1.3 million deficit is anticipated because we are projecting revenue of $29 million and expenses of $30.3 million. The programmatic changes to the experience and examination programs are anticipated to result in a “new normal” level of Record services that is lower than that of the last few years. Specifically, the streamlined experience requirement of 3,740 hours versus the previous 5,600 hours and the realignment of the former 17 Intern Development Program (IDP) experience areas to six practice-based areas is expected to reduce the timeline to licensure, while maintaining high standards and rigor.

In the examination program, we expect to see a significantly reduced volume of ARE divisions administered for the following reasons:

- ARE 5.0 has six divisions rather than the seven divisions of ARE 4.0. This represents an approximate 15 percent decline in the number of divisions that will be administered each year.

- Additionally, we experienced an unusually high volume of exam deliveries as we delivered both ARE 4.0 and 5.0 concurrently, until June 30, 2018, when ARE 4.0 was discontinued.

- Finally, the high volume of deliveries we have experienced in the last few years of exam transition will cease entirely when ARE 4.0 is no longer available.

All of these changes will facilitate not only a more streamlined path to licensure, but a path that is financially beneficial to candidates.

Long-range Forecast

We are also projecting deficits for a few more years beyond next year as we adjust to this “new normal” level of service delivery.

This chart shows a recent history of the Council’s bottom lines, as well as the projections for the next few years. The first four green bars show that fiscal years 15, 16, 17, and 18 had healthy bottom lines primarily due to abnormally high levels of exam activity. This enabled us to contribute to our reserve accounts in anticipation of upcoming lean years.

The next orange bar shows that FY19 is projected to be a planned deficit year. This is largely a paper loss resulting from non-cash activities. This projected loss is not a surprise. In fiscal years 20, 21, and 22, we expect that all programmatic changes will be fully implemented, and we will arrive at a “new normal” level of activity.

In the coming fiscal years, we will rely on our reserves to cover operations and avoid raising fees. Our business development activities can be funded through a line of credit that is collateralized by our Strategic Reserve Fund, if necessary, until they are self-sustaining. We have been expecting these coming deficits and we have planned for them. The reason we did is because we do not wish to increase fees, and we do not wish to decrease services just to eliminate deficits. For an organization in a state of growth—as NCARB is—occasional deficits are nothing to be feared. They are just something to plan for.

A spot of good news is that these deficits are smaller than we previously expected. We also have a history of budgeting conservatively and will not be surprised should the final outcomes in each year be better than these projections. However, in the event of unexpected economic developments, CEO Michael Armstrong has already briefed the Board on contingency plans that can be enacted immediately, if necessary.

Cash Flow

This chart is similar to the last one, which showed our long-range forecasts. This one, however, shows our operating cash balance. As you can see, after FY19 our cash balance increases every year. By FY22 we will be putting money in our Strategic Reserve Fund again.

The Council office is moving to another building next year. This new lease will save us $5 million over the term of the lease, and NCARB won’t pay rent until two years after we move in. Accounting rules, however, require the Council to show pro-rated rent expense over the life of the lease, even though we aren’t writing checks. In addition, our current lease doesn’t expire until December 2020. We are writing monthly rent checks until that time and must show that expense as well.

New Business Development

You may have heard that NCARB has launched some new business opportunities by expanding and licensing NCARB’s proprietary software. Our initial focus will be to become a vendor providing a license management system for licensing boards. Additionally, marketing is underway on licensing Lineup™, a volunteer management system that was developed for our staff and incoming presidents.

Licensing our technology may lead to new revenue sources that can provide a hedge against future fee increases, enable us to explore some further fee reductions, and provide funding for new services to our Member Boards and customers. The Board of Directors has authorized a limited amount of our Strategic Reserves to fund the launch of these opportunities. Forays into this new realm will have no impact on existing services to Member Boards or customers.

I want to remind members that if they are interested in following the Council finances throughout the year, we post the unaudited interim financial statements on the Member Board Community every quarter.

I am confident that there has been a very thoughtful approach to managing the financial impact of the changes the Council is experiencing as a result of our new and growing programs. We have carefully planned for these deficit years. The Council will continue to provide excellent service while maintaining fiscal solvency during these future periods.

Financial Highlights

FY18 Year-end Results

Council Financial Health

FY19 Budget

Long-range Forecast

Cash Flow

New Business Development

Home

Architects

Licensure

Candidates

Members and Volunteers

Inside

NCARB

Members and Volunteers

Leadership Reports

Serving Member Boards

NCARB + NAAB

2018 Annual Business Meeting

Committees

Regions

Ethics

Paths to Certification

Continuing Education

Re-Think Tank

Futures Task Force

NCARB + AIA

Professional Practice Initiatives

Licensure Candidates

Education

NCARB + AIAS

Examination

NCARB by the Numbers

Think Tank

Outreach

Architect Licensing Advisors

NCARB Centennial

Corporate Social Responsibility

CEO Report

Bylaws

Financials

Organizational Chart

1801 K Street NW Suite 700K | Washington, DC 20006

Phone: 202-879-0520 | Fax: 202-783-0290 | www.ncarb.org

© 2018 National Council of Architectural Registration Boards